cryptocurrency tax calculator ireland

This means you can get your books. Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier.

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

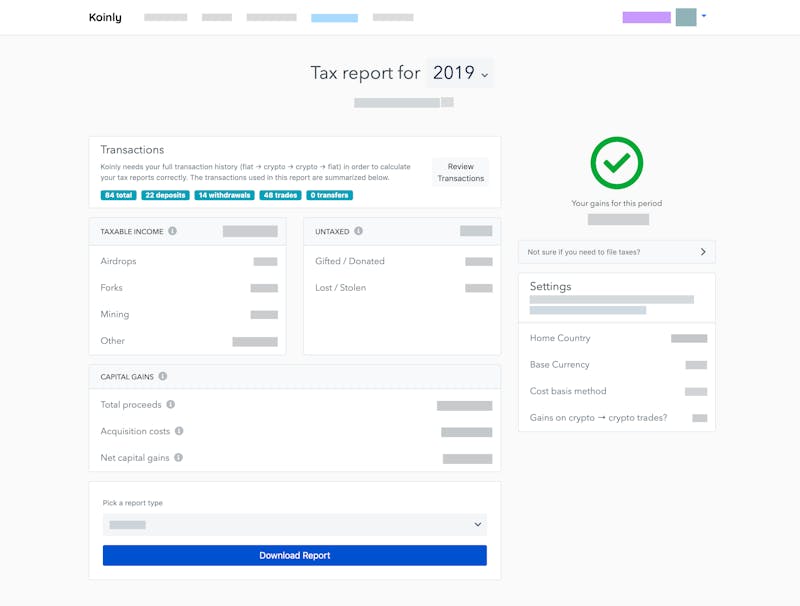

You simply import all your transaction history and export your report.

. How to use a Bitcoin ATM in Seconds. All companies listed here are well versed with cryptocurrency trading. Cardano Abu Stake Pool.

Find a certified tax professional specializing in cryptocurrency taxes to help with your declarations. As with any other activity the treatment of income received from charges. See Taxation of crypto-asset transactions for guidance on.

Heres an example of how to calculate the cost basis of your cryptocurrency. Generate ready-to-file tax forms including tax reports for Forks Mining Staking. If you hold your cryptocurrency for less than one year youll pay short-term capital gains taxes at your normal income tax rate which could be from 10 to 37.

Cryptocurrency Tax Ireland. If you are tax resident in Ireland then you need to pay Capital Gains Tax CGT of 33 on any profit you make on the disposal of a cryptocurrency. This means that profits from crypto transactions are subject.

You then deduct your personal exemption to find your taxable gain which is 2000 - 1270 730. CryptoTaxCalculator is an online tax tool to help users organise and convert transactions to make the tax process easier. Take the initial investment amount lets assume it is 1000.

Your chargeable gain is therefore 3000 - 1000 2000. If you hold your. The direct taxes are corporation tax income tax and capital gains tax.

In other words if youre making profits or losses through the disposal of your cryptocurrency. If the individual incurs a loss on the sale that would typically be treated as a. Cryptocurrencies and crypto-assets.

10 to 37 in 2022 depending on your federal. Capital gains tax report. Coinpanda lets Irish citizens calculate their capital gains with ease.

You can discuss tax scenarios with your accountant. Best Places to buy Bitcoin Online. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11.

Best Platforms for Day trading Cryptocurrency in 2021. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. You simply import all your transaction history and export your report.

Irelands Revenue states that profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal. If an Irish resident individual sells a crypto asset at a profit any gain would typically be treated a capital gain and subject to capital gains tax currently 33. We are not a registered accountant and do not know your individual.

With the standard CGT. Irish resident individuals selling cryptocurrency. Direct tax treatment of cryptocurrencies.

We only list CPAs crypto accountants and attorneys. In Ireland crypto investments are treated just like investments in stocks or shares. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Divide the initial investment amount. In addition to 30 of the tax you also need to pay cess at 4 of the tax amount.

As with any other activity the treatment of income received from charges. In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. There are no special tax rules for cryptocurrencies or crypto-assets.

Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. Please refer to the example below. The simple answer is yes.

That is the profits from trading will be taxable under Income Tax rules. Crypto Accountants in Ireland. Direct tax treatment of cryptocurrencies.

The direct taxes are corporation tax income tax and capital gains tax. To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value.

Cryptocurrency Tax Guides Help Koinly

May 2019 List Of All 39 Monthly Dividend Stocks Sure Dividend Dividend Stocks Dividend Dividend Investing

Ireland Cryptocurrency Tax Guide 2021 Koinly

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Top 10 Crypto Tax Free Countries 2022 Koinly

How To Calculate Crypto Taxes Koinly

Calculating Your Crypto Taxes What You Need To Know

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker